filters

Explore All Topics

88 results | Page 1 of 6

5 days ago

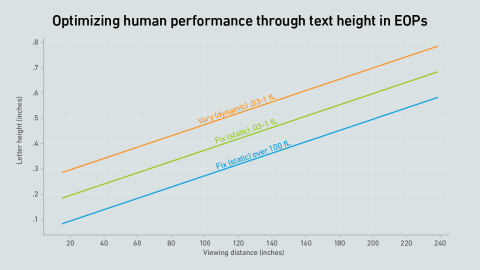

Digital EOPs: the appliance of science

Intelligence Updates

8 min read