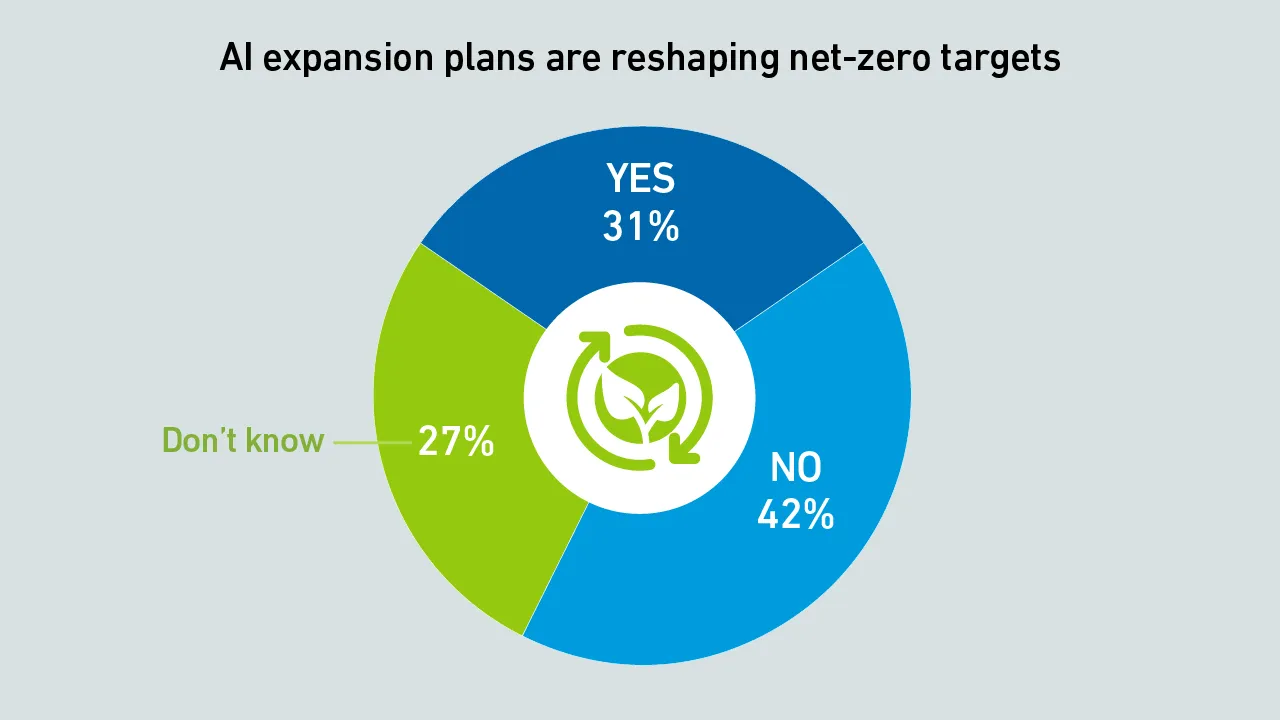

Surging demand for AI data centers is driving a shift to on-site natural gas power, even though operators admit this will delay the achievement of net-zero goals.

Peter Judge

Peter is a Senior Research Analyst at Uptime Intelligence. His expertise includes sustainability, energy efficiency, power and cooling in data centers. He has been a technology journalist for 30 years and has specialized in data centers for the past 10 years.

pjudge@uptimeinstitute.com

Latest Research

Ireland has issued new conditions for large grid loads and proposed new codes for data center connections; similar measures are expected to follow in other locations.

European national grid operators are advised to adopt proposed grid code requirements to protect their infrastructure from risks, such as data center activity, even though Commission action on the issue has stalled.

Japan is expected to issue data center regulations in 2026: data centers that do not meet a 1.4 PUE limit will face penalties. However, enterprise data centers appear to have evaded the stipulations.

A last-minute revision to the European Commission’s plans to simplify regulations has brought some companies back under the scope for CSRD reporting.

Data4 needed to test how to build and commission liquid-cooled high-capacity racks before offering them to customers. The operator used a proof-of-concept test to develop an industrialized version, which is now in commercial operation.

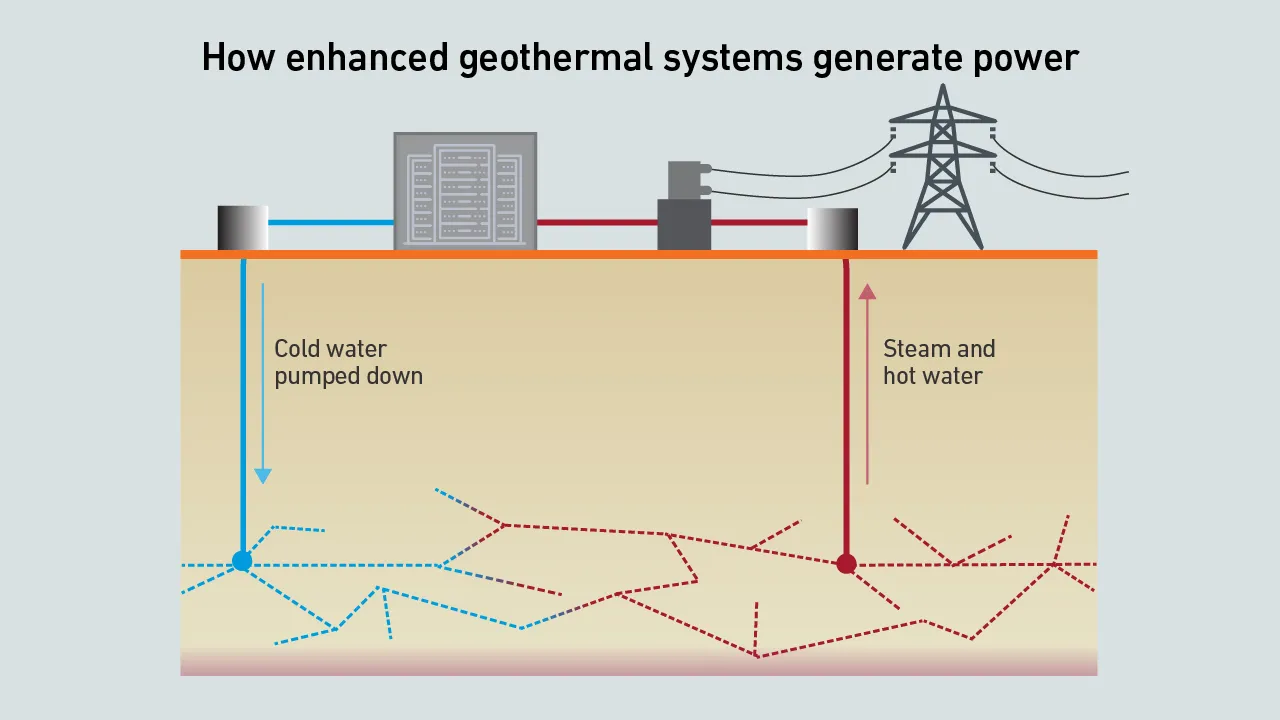

Enhanced geothermal systems use advanced drilling and hydrofracturing techniques to access geothermal energy in more locations. Some data centers may use enhanced geothermal energy for on-site, low-carbon power.

The European Parliament plans to simplify environmental reporting beyond what the Omnibus proposed in early 2025. Under the new reporting thresholds, only the largest 10% of companies would remain subject to CSDDD and CSRD requirements.

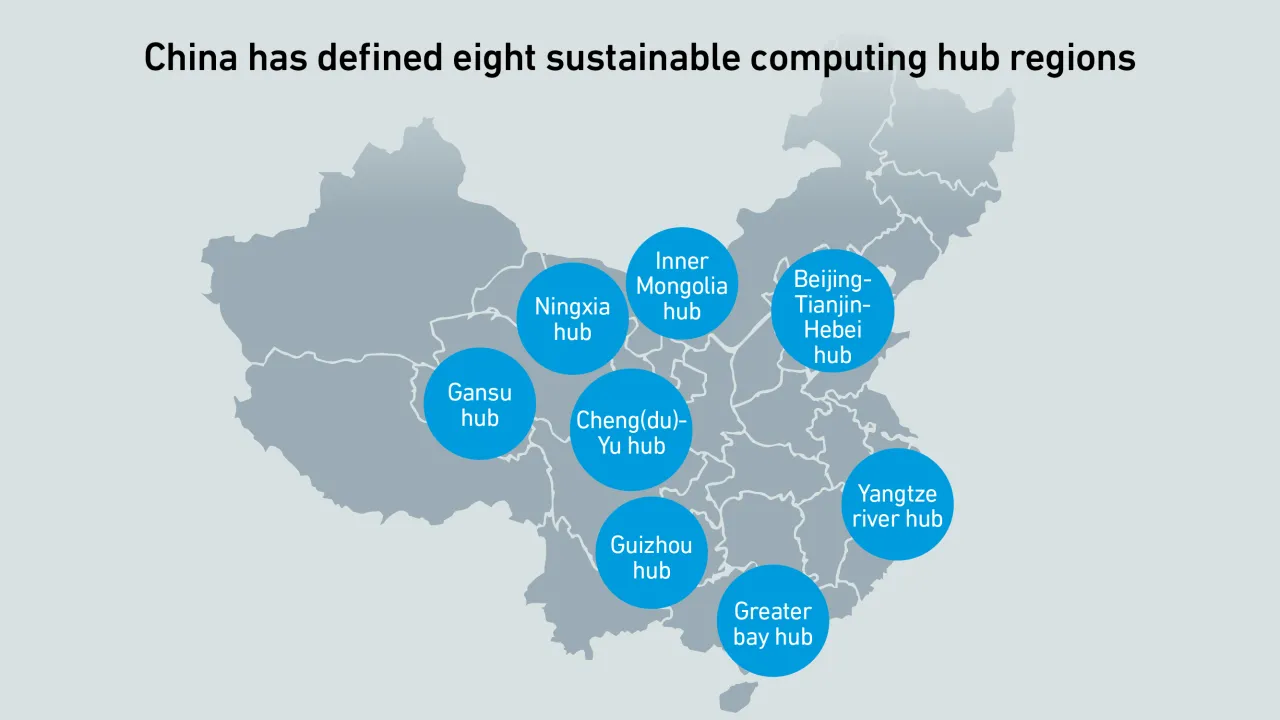

China wants to expand its data center capacity, and to achieve net-zero emissions. To this end, the nation is regulating for efficiency and renewable energy, as well as harnessing centralized control, to balance growth with sustainability.

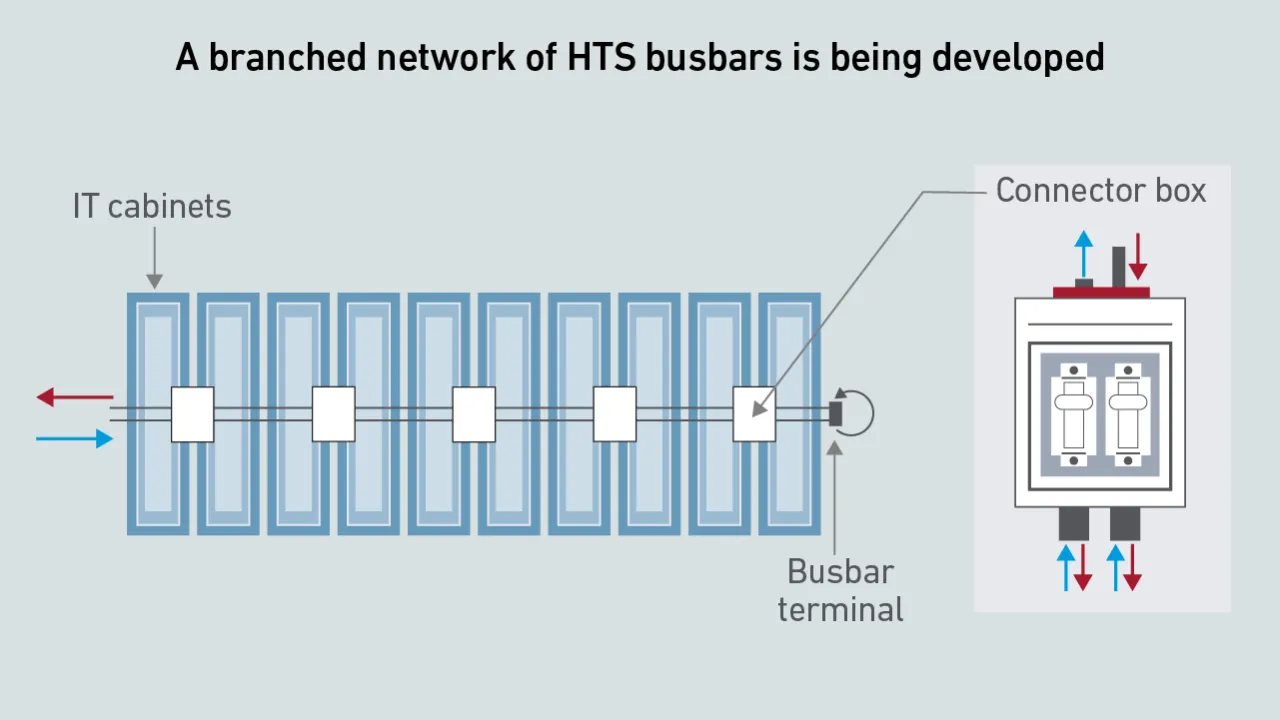

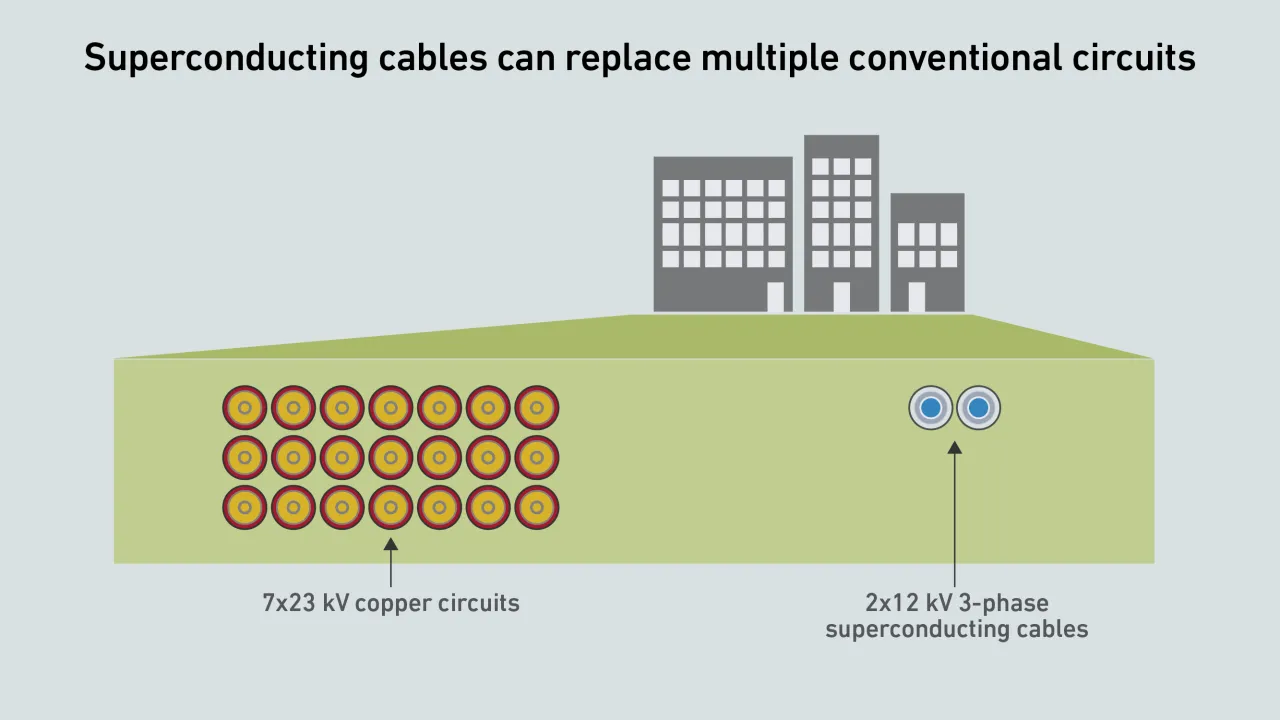

Superconducting busbars could offer a solution for delivering power to high-density racks, eliminating resistive heating and removing the need to shift to medium voltage distribution equipment.

Fewer people in the industry are talking about sustainability. But why has the collection of data also declined, when such data is often required by reporting regimes?

Sodium-ion batteries promised a third battery option to lead-acid and lithium-ion batteries. The closure of Natron Energy means operators will need to look elsewhere.

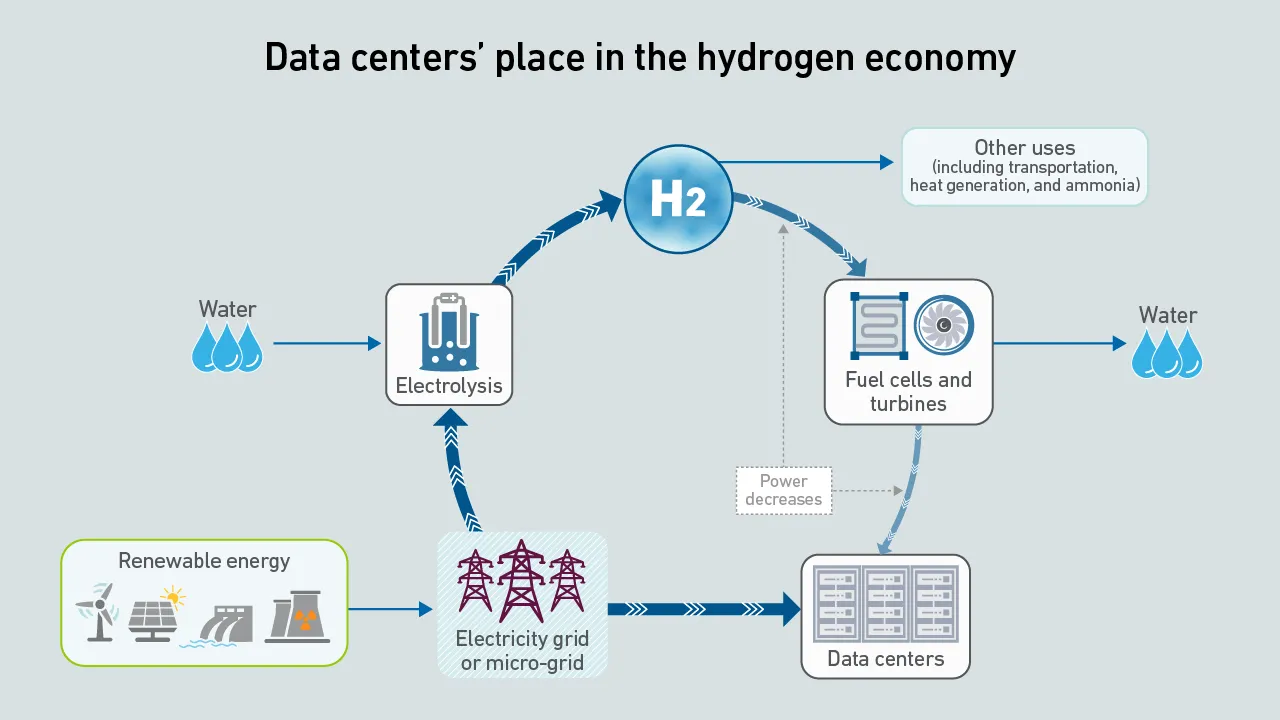

Operators looking for low-carbon power may be assessing low-carbon hydrogen for standby or primary power. Except for niche applications, the technology is a long way from practicality.

Superconductive power cables promise faster, cheaper and simpler connections for data center operators waiting for power. They could also simplify campuses and microgrids.

In Northern Virginia and Ireland, simultaneous responses by data centers to fluctuations on the grid have come close to causing a blackout. Transmission system operators are responding with new requirements on large demand loads.