UII BRIEFING REPORT 114 | OCTOBER 2023

Briefing Report

Heat reuse: a management primer

Almost all the energy consumed by data centers is converted into heat, which is typically rejected into the environment. Technologies that enable data center operators to capture and recycle this “waste heat” are well understood but rarely used. This report investigates the current state of data center heat recovery projects and looks at the factors that are likely to influence the development of this field in the next three to four years.

KEY POINTS

- A cold climate and widespread use of district heating networks have made Northern Europe the global leader in waste heat recovery, with nearly 60 documented projects across hyperscale, enterprise, colocation, high-performance computing (HPC) and edge facilities.

- The EU’s Energy Efficiency Directive (EED) recast will require member states to ensure that data centers with a total energy consumption of 1 megawatt (MW) and above utilize waste heat recovery, or show that such recovery is technically or economically unfeasible.

- Quantifying the commercial value of waste heat is difficult: both the heat output of the data center and the price of heat delivered to the customer are variable, with demand often driven by the season.

- Advances in district heating networks, growth in IT equipment density and greater adoption of liquid cooling will improve the viability of data center waste heat recapture projects.

What is waste heat recovery?

Data centers exist to provide space, power and cooling to the IT equipment that delivers digital products and services. Virtually all the electricity consumed by IT is converted into heat, the effective removal of which is one of the primary objectives of data center facilities.

Heat is a byproduct of data center operations and has largely no value, hence “waste heat.” The main means of disposing of this heat load is through rejection into the atmosphere. In most climates, this process requires additional energy and often large quantities of water.

If heat can be economically reused instead of dumped into the environment, however, it becomes a valuable commodity for a range of industrial, agricultural, commercial and residential purposes. As much as 90% of the energy used by data center IT can be recovered as heat, which could provide thousands of megawatts of thermal power globally.

The idea is an attractive one. However, thermodynamics and economics weigh down the business case. Making use of data center waste heat adds complexity to planning, involves additional engineering and requires a sizeable upfront investment to purchase and install the necessary equipment to transport the heat to customers (sometimes called off-takers). It is often difficult to find an application for the typically low-temperature waste heat produced by data centers and in many climates, it makes no sense to use it at all.

Nonetheless, the number of data center heat recovery projects is growing, especially in Northern Europe, where district heating networks are more common. According to the Open Compute Project, there are currently around 60 such projects in Europe and six in North America. A further 11 projects are in development or under construction. While these numbers seem small when considering the size of the global data center market, they are helping to build familiarity with the technical and business implications of data center heat reuse schemes.

The difficult business case of waste heat recovery

Waste heat recovery can improve the overall energy performance of data centers by helping to reduce the primary energy consumed for heating purposes in industrial, commercial or residential buildings, which often rely on gas heaters or boilers. This creates a category of “avoided” greenhouse gas (GHG) emissions, which the research organization World Resources Institute has termed Scope 4 emissions. Although not mandatory, some companies are already including avoided emissions in their ESG reporting.

Data centers use a significant amount of energy for cooling, often as much as 20% to 30% of the total power consumed. Waste heat recovery can reduce much of the cooling-related power consumption by absorbing the thermal load without the need for mechanical refrigeration or other heat rejection methods.

Consequently, the cost of operating data center cooling equipment can be reduced or even eliminated when waste heat is recovered. However, the same cannot be said about the capital expenditure on cooling equipment. The facility will still need the capacity for heat rejection in case there are any issues with heat transport, which is not under the control of the data center operator.

Even if the heat exchange and transport connections are redundant (or at least concurrently maintainable), it may not always be possible to guarantee that an off-taker will be ready to consume the recovered waste heat. Periods of low customer demand, maintenance, outages and bankruptcies can all jeopardize the dependability of a heat reuse scheme for heat rejection.

There are some exceptions, such as centralized district heating and cooling networks with multiple take-off points and sufficient systemic redundancy, but generally a heat reuse scheme does not provide sufficient resilience for mission-critical applications.

Quantifying the commercial value of waste heat is difficult because both the heat output of the data center and the price of heat delivered to the customer are variable — demand is often driven by the season. In many cases, data centers offer waste heat for free rather than as a commercial service. Some of the issues with seasonality can be offset by investments in thermal energy storage.

While it is possible to turn a profit from waste heat, most projects today are focused on reducing the environmental impact of the data center — and reaping the associated benefits related to investment, marketing and public image — rather than treating heat as a revenue source.

There are many uses for the waste heat generated by industrial processes (these are discussed in Applications for waste heat), and potential applications are being suggested on a regular basis. However, by far the most popular is the supply of heat to existing district heating networks.

Several district heating network operators have developed business models that purchase waste heat generated by data centers. Most are located in Northern Europe, where the climate creates a greater demand for commercial and residential heating. In Sweden, for example, current projects include Stockholm Exergi’s Open District Heating, Vattenfall’s SamEnergi and Delad Energi operated by Tekniska Verken i Linköping.

The countries taking the lead in heat recovery

The countries and regions taking steps to encourage waste heat recapture are those where such projects have been proven to make the most economic sense and where sustainability ranks high on the agenda for businesses and policymakers alike.

Stockholm in Sweden has established itself as a world leader in large-scale waste heat recovery from data centers, with 30 facilities plugged into its district heating networks.

In Denmark, around 60% of homes are already connected to a district heating network, which makes waste heat reuse projects relatively simple to implement.

Finland is another Nordic country with extensive district heating networks and a growing waste heat market. Much of it is spearheaded by local energy giant Fortum, which buys heat from at least three data centers. In 2022, Fortum announced the world’s largest data center heat recovery project, which aims to utilize the heat produced by Microsoft’s cloud data centers in Espoo and Kirkkonummi. When fully equipped, these facilities are expected to provide 40% of all heating required by around 250,000 residents of the region.

District heating networks are less common in North America, where they are often used in institutions, such as college campuses or government complexes. While this opens up the potential for partnerships with the public sector, most data center waste heat recovery projects in the US and Canada focus on agriculture — and more are being developed in this sector.

How waste heat is captured and transported

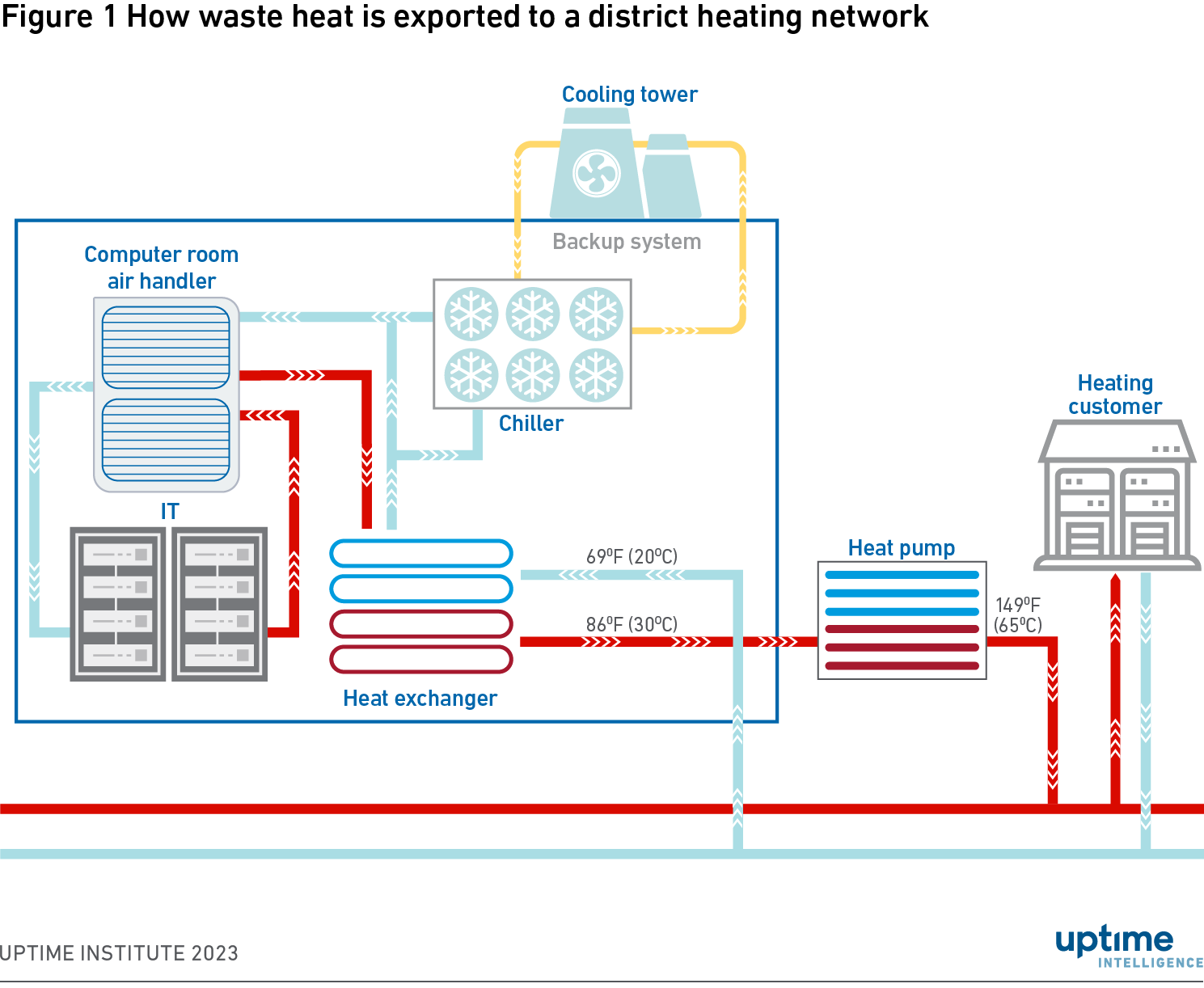

The higher its temperature, the more valuable and versatile waste heat becomes. Using water instead of air as a means of heat transport enables many more applications. In the case of an air-cooled data center, moving heat often requires heat transfer — through a heat exchanger — into water (see Figure 1).

The liquid-cooling of IT hardware, which allows for elevated facility water temperatures compared with air cooling (e.g., an 89.6°F / 32°C supply as opposed to 68°F / 20°C), makes heat recovery more effective. This also enables the data center to bypass the heat exchange between air and liquid in which some energy would be lost.

If higher water temperatures are necessary, heat can be concentrated using water-source heat pumps. For district heating applications, a water temperature of at least 149°F (65°C) is required in the supply line when outdoor temperatures are above freezing levels. At lower outdoor temperatures, higher supply temperatures are required, up to 212°F (100°C) when it is -0.4°F (-18°C) outside.

It is not always necessary to supply water at a high temperature, even for district heating applications. For example, “low-grade heat” can be used to feed the return side of the district heating network, which collects warm water after it has left the customer’s premises. This means the district heating operator can spend less energy to get the water to the required temperature before it is once again supplied to customers.

Data centers can also supply warm water or hot air if the customer is in the immediate vicinity. For example, when heating offices in the same building or a warehouse that is used to dry agricultural produce.

What is a heat pump?

A heat pump is a device that uses electricity, compressors and refrigerant to concentrate thermal energy. Heat pumps can transform low-grade waste heat, which is typically between 32°F (0°C) and 77°F (25°C), into higher-grade heat between 140°F (60°C) and 194°F (90°C). Multi-stage heat pumps can achieve water temperatures of 302°F (150°C) or higher.

Although this process requires energy, it can transfer a heat output that is three to six times larger than the amount of electricity consumed. The carbon footprint of heat pumps depends on how this electricity is generated.

The industrial heat pumps used in data center heat recovery are expensive — generally more expensive than a comprehensive cooling system — but the costs are coming down. Some of their expenditure can be offset by government subsidies; more than 30 countries currently offer financial incentives to organizations that deploy heat pumps.

In some waste heat recovery projects, the installation and operation of heat pumps and insulated pipes is the responsibility of the organization that consumes the heat rather than the owner of the data center. For example, this could be a district heating network operator. In such cases, the heat is usually provided free of charge.

According to the International Energy Agency (IEA), global sales of heat pumps rose 11% year on year in 2022. The IEA said increased policy support and incentives for heat pumps in light of high natural gas prices and efforts to reduce GHG emissions were behind the strong uptake.

Growing policy interest in waste heat recovery

Governments globally are starting to take more interest in waste heat recovery schemes. In Europe, some EU member states as well as the EU itself are actively considering legislation to mandate heat reuse for new data center construction.

The new legislative tool that is likely to have the most impact is the Energy Efficiency Directive (EED) recast (see The EU’s Energy Efficiency Directive: ready or not here it comes). Article 24, item 3a of the directive requires that EU member states ensure that data centers with an IT capacity of 1 MW and above utilize waste heat recovery or show that such recovery is technically or economically unfeasible.

At a minimum, data center operators will need to conduct a cost-benefit analysis of waste heat recapture for any new facility in the EU. If the operator decides against the installation of a heat reuse system, the EED requires that the EU member state audits the operator’s feasibility study to ensure its unfavorable conclusion is valid.

Data center operators involved in waste heat recovery schemes will have to disclose their efforts as part of regular EED sustainability reports — the first is due in May 2024 (subject to delays owing to a tight legislative timeline). They will do this using a relatively new metric called the Energy Reuse Factor (ERF), which is defined by the European standard EN 50600-4-6 (Information technology: data centre facilities and infrastructures).

The ERF provides an assessment of the mitigation of carbon emissions that originate from energy consumption in a data center. It is calculated by dividing the energy captured and reused by the total energy consumption on an annual basis.

Some European states have also implemented their own initiatives in parallel to the EED:

Germany. The current (recently revised) text of the proposed update to the Energy Efficiency Act, which transposes the EED into national law, sets a more aggressive target. It specifies a heat recovery quota for all new data centers that starts at 10% of the thermal load in 2026 before increasing it to 20% in 2028.

The law provides some exemptions. And those data center operators that do not have suitable customers nearby will be able to satisfy the requirements by equipping their facilities with an on-site heat transfer station so they can offer heat in the future.

- Denmark. Recent tax cuts on waste heat from electrical processes along with pricing regulations are making it easier and financially more attractive for data centers to sell their waste heat.

- Netherlands. Amsterdam and Haarlemmermeer municipalities now require all new data centers to explore the use of waste heat for heating nearby homes.

- Norway. The government has introduced a condition for all new data centers above 2 MW to explore the utilization of their waste heat. This law will likely be superseded by the new EED requirements.

Waste heat recovery is also getting more attention from industry organizations. The Climate Neutral Data Centre Pact — a European self-regulatory initiative — has identified waste heat recycling as one of its five priorities. The Pact is planning to launch a dedicated working group to establish best practices for recovering waste heat and investigate the barriers to adoption.

More than 100 of the Pact’s signatory organizations have agreed to explore the potential of waste heat reuse and establish whether it is practical, environmentally sound and cost-effective to implement in their facilities.

The European Code of Conduct for Energy Efficiency in Data Centres is another voluntary initiative that requires signatories to consider the potential of waste heat recovery. So far, more than 120 data center organizations have signed up to this framework.

The Open Compute Project (OCP), an industry collaboration on open-source design of data center equipment, is running a heat reuse sub-project by publishing a series of resources to encourage the uptake of waste heat recovery. In addition to technical best practices, the OCP is planning to introduce a matchmaking platform that would connect data center operators with heat consumers.

State-sponsored project Bytes2Heat is aiming to create a similar platform for Germany. The project is supported by multiple academic organizations, industrial equipment suppliers and utilities E.ON and Engie.

Most data center heat recovery projects rely on district heating networks as heat off-takers. This model could become more widespread with the growing support for district heating, which is seen as more environmentally sustainable than on-premises boilers and is relatively cost-effective.

For example, the UK government is investing £320 million ($395 million) in district and communal heating networks as part of its efforts to decarbonize heating and cooling. It estimates that such networks could meet up to 20% of the country’s total heating demand by 2050, up from 2% today.

Advances in district heating networks

District heating networks have their origins in the heated baths and greenhouses of the Roman Empire. Modern district heating is commonly classified into five generations, with the most recent advances designed to make waste heat recapture much easier to implement.

The third-generation district heating has been in use since the 1980s and is the most common technology in operation today. The key difference from previous generations is that lower water temperatures in the network are enabled by prefabricated pipes insulated with polyurethane foam and plastic cases, which are welded together on-site.

Fourth-generation district heating networks are focused on further lowering the supply and return line temperatures from around 122°F (50°C) to as low as 68°F (20°C). Lowering the temperature range creates more opportunities to integrate waste heat from industrial processes, including data centers.

Fifth-generation district heating networks — of which there are only a few — rely exclusively on electricity and industrial waste heat, with required water temperatures between 50°F (10°C) and 86°F (30°C).

Fourth- and fifth-generation district heating networks have the most attractive conditions for data center waste heat recapture.

Applications for waste heat

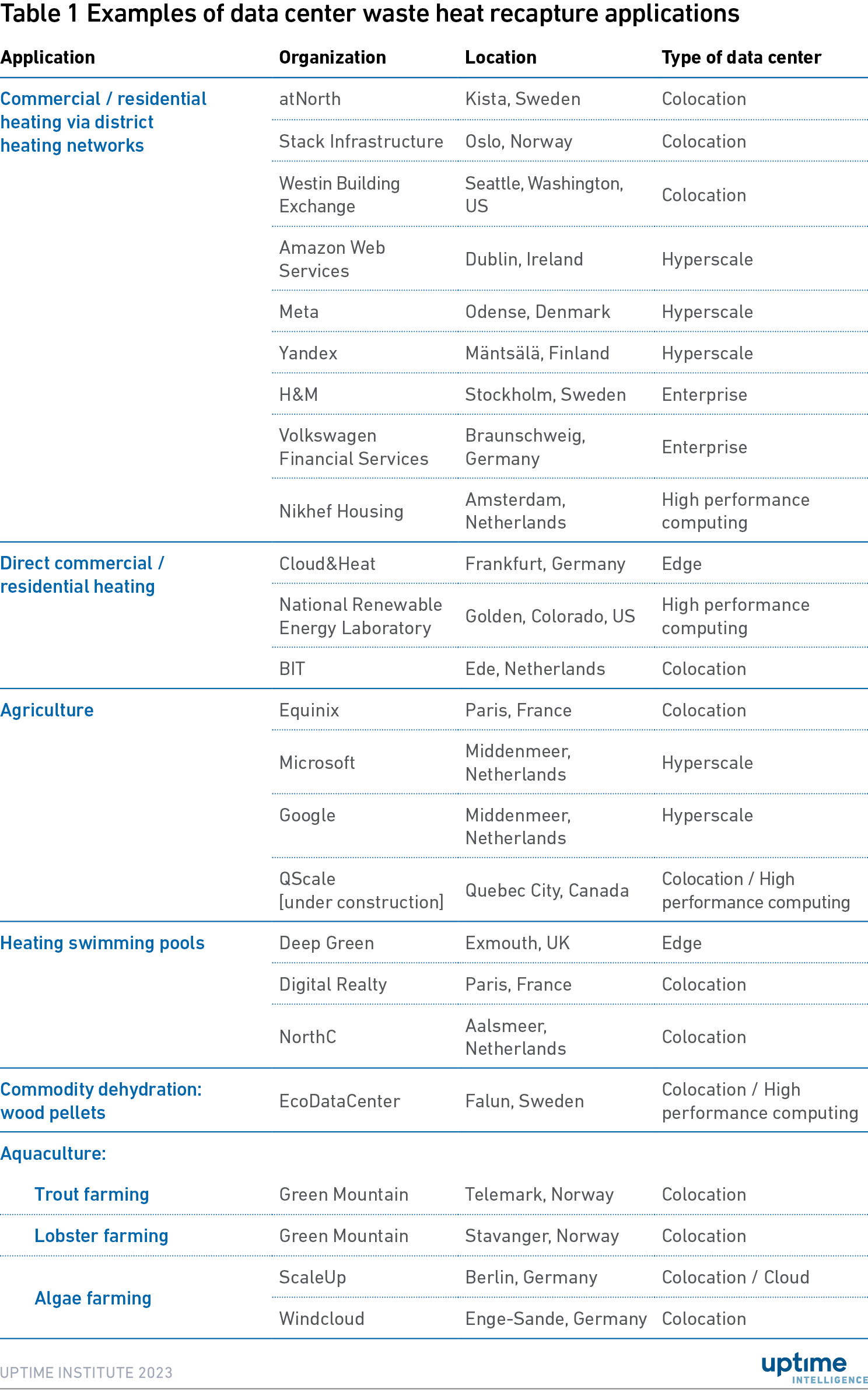

Waste heat recovery has been implemented across all types of data centers, including hyperscale, enterprise, colocation, high-performance computing (HPC) and edge facilities.

Data centers in urban areas are more likely to export their heat through district heating networks, while data centers in rural areas typically partner with industrial organizations and contribute to commodity dehydration, agriculture or aquaculture.

Table 1 is not intended to be an extensive list of all waste heat recovery projects in operation but to provide a mix of the different applications, data center types and geographies.

Trends in IT equipment

The power densities of IT equipment are increasing over time. Servers equipped with the latest-generation server processors and compute accelerators, such as graphics processing units and application-specific silicon, produce more concentrated heat. This makes data centers more attractive as a heat source.

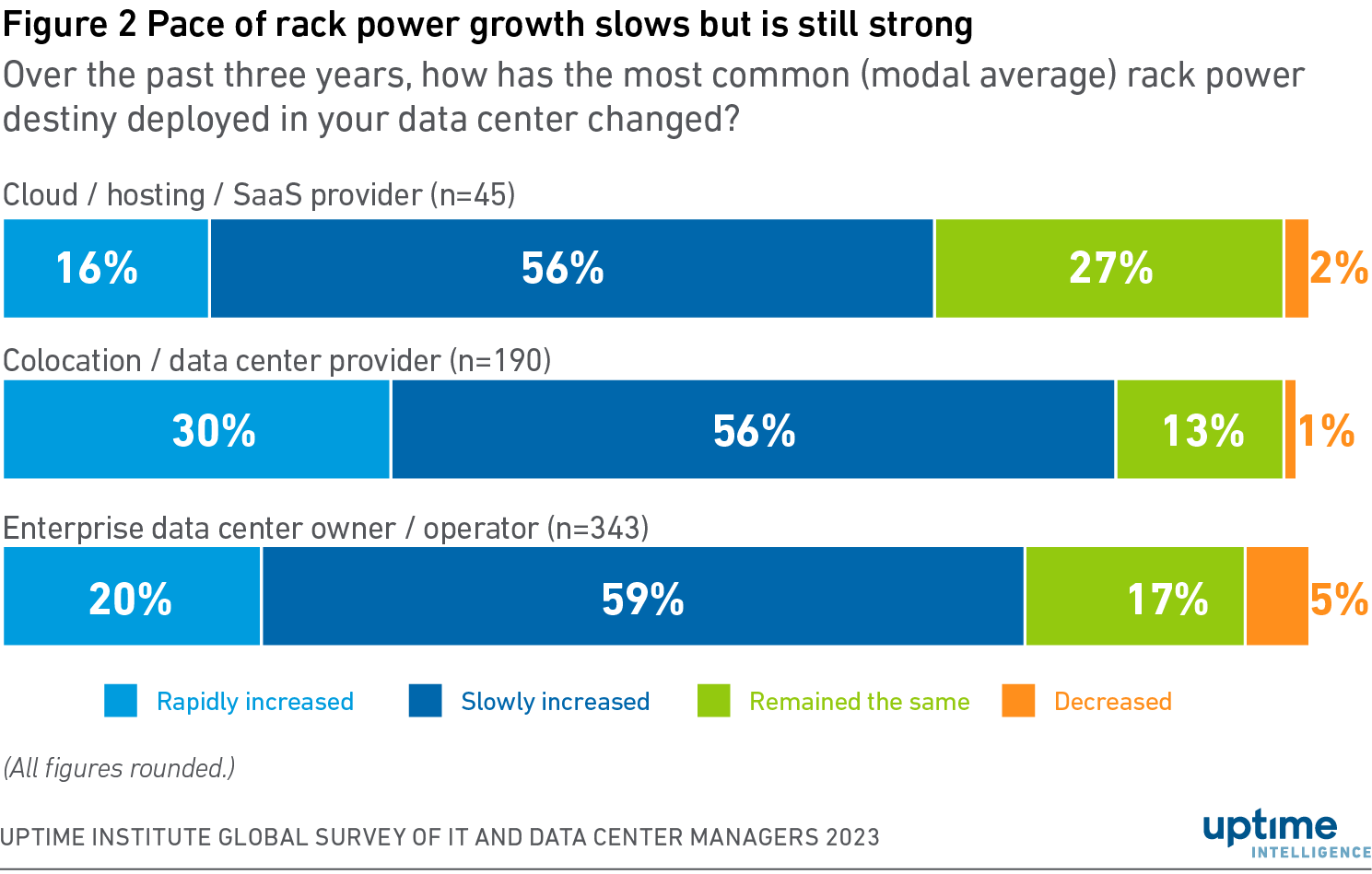

According to the Uptime Institute Global Data Center Survey 2023, while 4 kilowatt (kW) to 6 kW IT racks remain the most common, one in five operators now report that racks consuming 10 kW or more are becoming the standard in their facilities. More than 70% of respondents say their rack densities have increased over the past three years (see Figure 2).

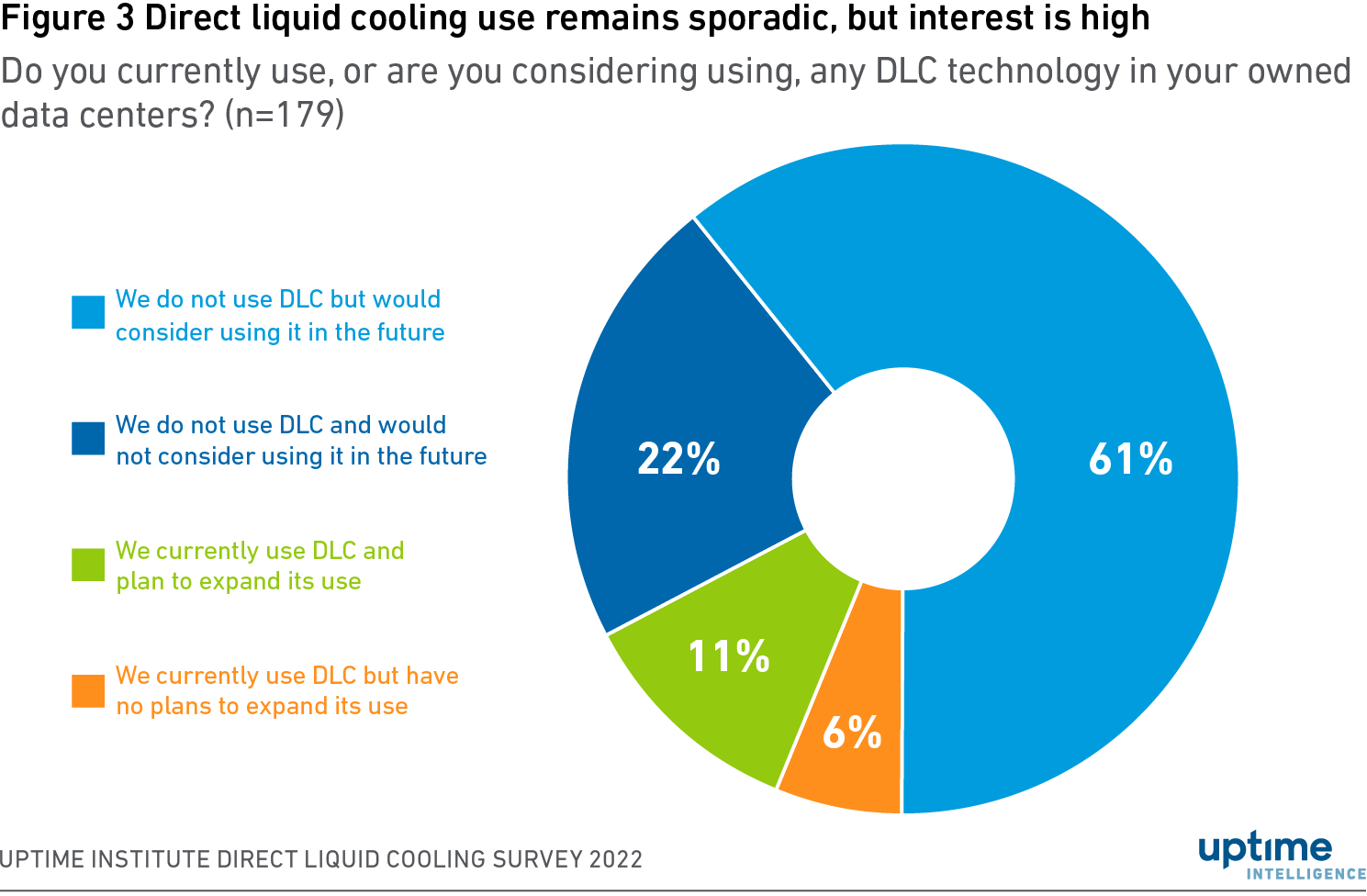

Further densification of racks is expected to boost heat-generation capabilities, but what could potentially bring a step change in the value of data center heat is direct liquid cooling (DLC) of IT. Thanks to their superior thermal conductivity and storage capacity, water or other engineered fluids are able to deliver sufficient cooling capacity to IT electronics at considerably higher temperatures compared with air.

Industry body ASHRAE recommends that data center operators keep air supply temperatures under 80.6°F (27°C). This limits the maximum amount of heat a data center can export without applying heat pumps at around 86°F (30°C), even when the facility water temperatures (including the temperature delta between supply and return) are ambitiously elevated. Most operators settle on more conservative set points, which lower the temperature of their waste heat. Some liquid coolants, however, can operate at 104°F (40°C), which could bring the waste heat output closer to 122°F (50°C).

Since the temperature of facility water is higher when using liquid cooling, these systems can potentially reduce or even eliminate the need for heat pumps.

According to the Uptime Institute Direct Liquid Cooling Survey 2022, about one in six operators already use some form of liquid cooling in their facilities (see Figure 3). Nearly one in five respondents expect that more than half of their server racks will incorporate some form of liquid cooling within the next three to five years.

The ability of liquid-cooled systems to provide the required level of temperature for on-site heating applications without the use of heat pumps has been established in test conditions at the RISE institute in Sweden. Although the research team found that the cost of liquid cooling is usually higher than air cooling, the ability to sell the waste heat creates opportunities to have a payback of the additional cost within a few years.

Compute-intense workloads that are not latency-sensitive are the best suited for waste heat recapture because they can be situated in locations that have district heating networks in place and where electricity is cheap, enabling savings on the use of heat pumps. Examples of these workloads include simulations, 3D rendering and modeling of complex systems, such as weather patterns.

Measuring the impact of waste heat recovery

Power usage effectiveness (PUE) is widely used as a measure of data center energy efficiency but is not always appropriate for facilities that export waste heat and receive cool water in return. When heat pumps are operated within the data center boundaries, the energy they use is included in the calculations of the energy spent on facilities. This often results in a higher PUE than traditional air cooling, which normally indicates poor energy efficiency. When looking from a perspective of a larger system, waste heat recovery actually lowers energy usage and reduces emissions overall.

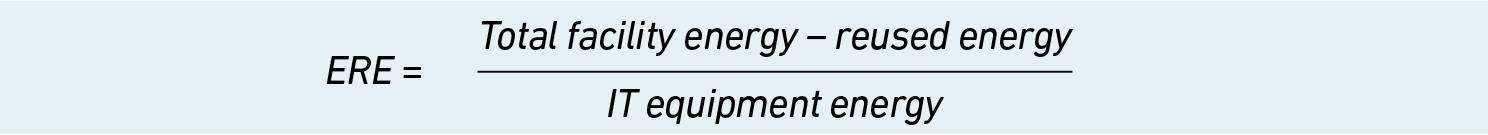

The growth in the number of waste heat recovery projects necessitates new metrics that account for the energy spent on concentrating and transporting heat to the boundaries of the data center, and several have been suggested so far. One example, proposed by The Green Grid in 2010, is energy reuse effectiveness (ERE), calculated as:

The economics of waste heat recovery

Data center waste heat recapture projects often require a large upfront investment in heat pumps and additional insulated piping in the facility. Insulated piping is also required to connect the heat transfer station, which can involve one or more heat pumps, to the customer. The cost also depends on the distance to the customer and can be significant.

Because of the amount of work required, waste heat recovery projects can take a long time to retrofit, as opposed to when they are designed as part of a new facility. Typically, retrofitting can take two to three years from the initial planning to the point where the facility is ready to export heat.

Another factor that plays a major role in the viability of waste heat recapture is the price that the customer is willing to pay for the heat — if it is provided as a commercial service, which is not always the case. For district heating applications, the pricing model often depends on the energy demand in the network — low demand means a low price and when demand is high, so is the price.

Currently, there are no common, well-established mechanisms to enable commercial applications of waste heat that can be applied across many different customers. This could be solved by matchmaking platforms that connect heat producers with heat consumers.

Higher overall energy prices are likely to make waste heat recovery projects more competitive and economically attractive.

Conclusions

Data center waste heat recovery is an evolving field that combines energy performance and sustainability. However, its appeal is mostly limited to specific regions, which are defined by their climate, history and politics.

Heat recovery introduces a set of new priorities during site selection, the most important of which is the presence of nearby customers who are ready to consume the heat recovered by the data center.

Waste heat recapture typically has a neutral or negative effect on energy efficiency because the operation of heat pumps may increase the total energy consumption. However, when analyzing data centers as part of larger systems — such as city districts — these schemes have lower overall energy consumption and GHG emissions.

Waste heat recapture from all sources presents a relatively straightforward method of decarbonizing industries and economies and it will likely remain an area of focus for governments and policymakers, especially in Europe. More rapid progress could be made if data center waste heat recovery is encouraged through some of the financial incentives currently enjoyed by sustainability and renewable energy projects.

Advances in district heating networks that enable the use of low-grade heat, growth in IT equipment density that increases the heat output of data centers, and the adoption of liquid cooling that simplifies the supply of hot water will improve the viability of waste heat recapture projects.

Many current waste heat recovery initiatives are custom, one-off endeavors. Standardization in parts, processes and business models is likely to develop over time. Even at this stage, after nearly 70 documented implementations around the world, waste heat recapture can be considered proven from the design point of view.

The key to the future of data center waste heat recapture is collaboration between municipalities, energy suppliers, heat consumers and data center operators. This will require new market structures, platforms and tools. Steps have already been taken in the right direction by both industry organizations, such as the Open Compute Project, and government-sponsored initiatives, such as Germany’s Bytes2Heat.

Another element currently missing is profitability calculators that can estimate the commercial viability of potential waste heat utilization projects in a given location.

Developments in waste heat recapture are likely to solidify the position of subarctic regions as prime locations for data centers. Northern Europe already offers some of the lowest operating costs when it comes to data center power and cooling. The popularity of district heating networks and first-mover advantage means that a handful of countries will likely remain at the forefront of waste heat reuse.

Irrespective of the economic benefits for data center operators, the number of facilities designed to export waste heat will increase as a result of growing sustainability pressures and regulatory attention. Large data center cooling equipment vendors are watching these developments with interest.