UII UPDATE 468 | FEBRUARY 2026

Intelligence Update

France sets strict PUE and WUE thresholds as tax incentive

The French government has issued draft legislation that proposes electricity tax incentives for data center facilities that meet minimum performance standards (MPS) for PUE and WUE. The public consultation period is now closed. The final legislative text is expected to be published during the second quarter of 2026 and come into force on January 1, 2027.

France is one of several countries globally with electricity tax incentives tied to energy efficiency or decarbonization. Passed in 2019, the Accise sur l'électricité offers reductions in the electricity tax for energy-intensive activities, including a significant reduction for data centers (the current tax of €22 per MWh can be reduced to €10). For a data center with an average electricity consumption of 10 MW, the annual tax reduction can exceed €1 million. The reduced tax rate applies to consumption exceeding 1 GWh per year, corresponding to an average power demand of 114 kW. This means that most data centers will be sufficiently large to qualify for the tax reduction.

To qualify for a reduced electricity tax rate, a data center must implement a certified energy management system (such as ISO 50001) and adhere to a recognized benchmark of good energy practices (such as the EU Code of Conduct for Data Centres). This is further discussed in the Uptime Intelligence report French data center policies affecting sustainability.

The French authorities have recently proposed quantitative requirements on operational PUE and WUE that data centers can meet to qualify for a reduced electricity tax. Operators must keep inventories of metered data and may be subject to audits by French authorities (including retroactively for previous years). Facilities that reuse data center waste heat are exempt from the PUE thresholds but must still comply with the water usage effectiveness (WUE) threshold.

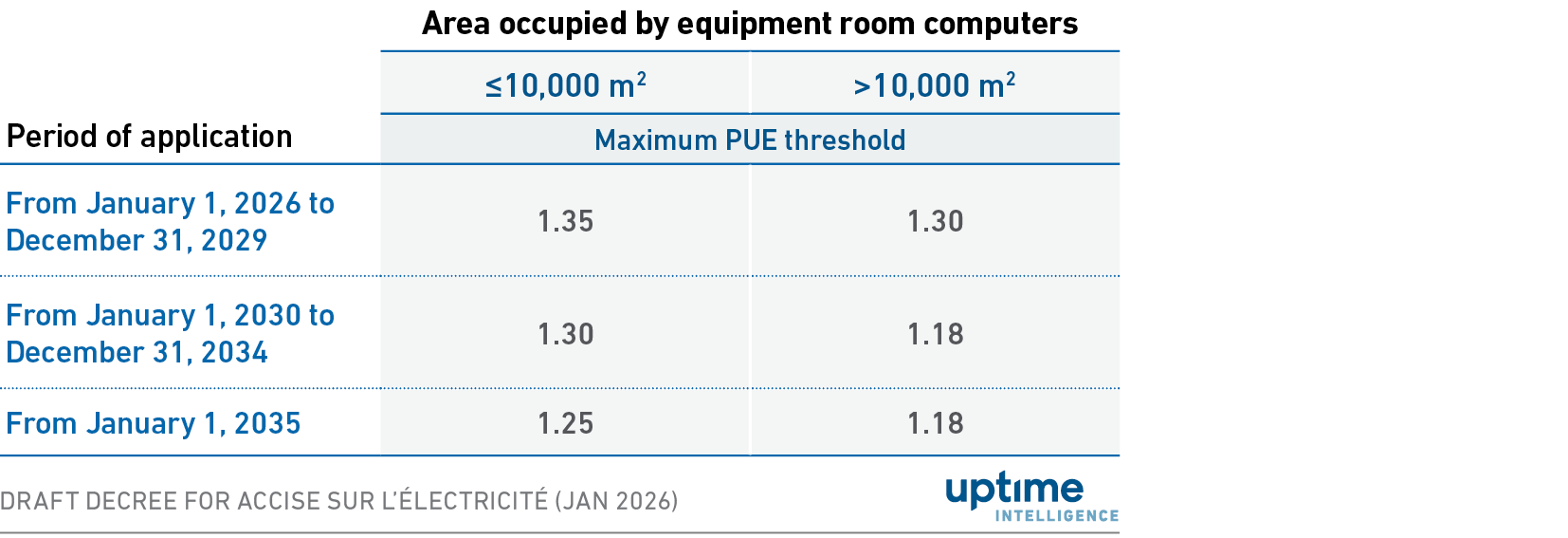

Two sets of operational PUE thresholds are proposed for data centers wanting to benefit from the reduced electricity tax in 2027. One set applies to data centers in general (Table 1), and another applies only to data centers with high utilization (>55%) of installed IT power (Table 2). A significant number of data centers will need to upgrade their cooling systems to qualify for the tax benefits.

Table 1 General thresholds for operational PUE

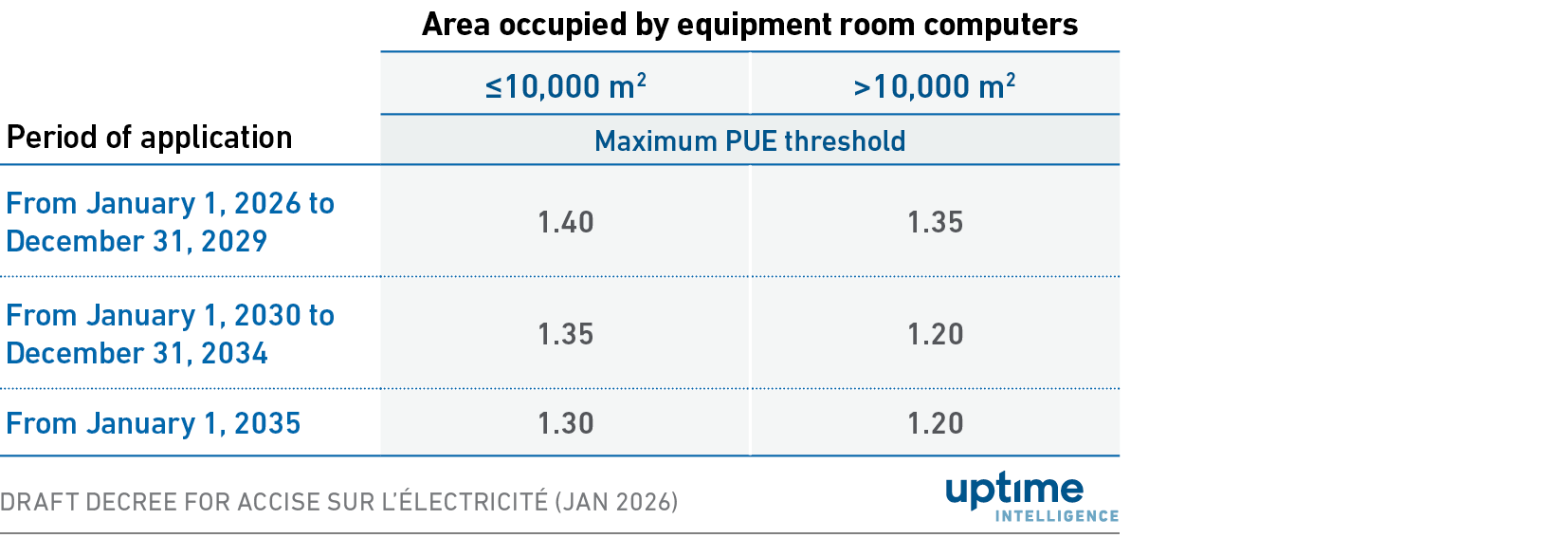

IT power utilization is the ratio of the average annual power used by IT equipment (annual IT energy use divided by 8760) to the maximum power demand of the IT equipment (accounting for redundancy). A data center becomes eligible for additional tax incentives at a less strict (higher) PUE threshold if the power utilization ratio is >55% (Table 2).

The draft regulation leaves the definition for "maximum power" to operators, which is a major omission. Maximum power can be defined as the nameplate power of the installed IT infrastructure (referred to in the EU's Energy Efficiency Directive, EED, as "installed IT power"), the maximum power demand of a configuration as calculated using the IT equipment manufacturers' power calculator, or the power capacity the data center dedicates to the IT equipment. If nameplate power is used to define maximum server power, few (if any) data centers will be able to meet the 55% threshold. Conversely, a data center can meet the 55% threshold by using the maximum power demand calculated from a manufacturer's power model. The French authorities need to define the maximum power in the regulation to enable an assessment of the appropriate threshold and to ensure consistent application of the tax incentive.

Uptime Intelligence has provided this input to French authorities and understands from those discussions that they are considering setting a lower threshold value in the final regulation.

Table 2 PUE thresholds for data centers with high utilization (>55%) of installed IT power

Notably, the operational PUE thresholds for data centers with high utilization of installed IT power (Table 2) are higher (less strict) than the general Accise sur l'électricité thresholds (Table 1). A high utilization of installed IT power can indicate that a facility operates close to its design PUE, and near its maximum efficiency. The PUE thresholds in Table 2 can enable older facilities with well-operated IT and less efficient cooling systems to still meet the Accise sur l'électricité criteria.

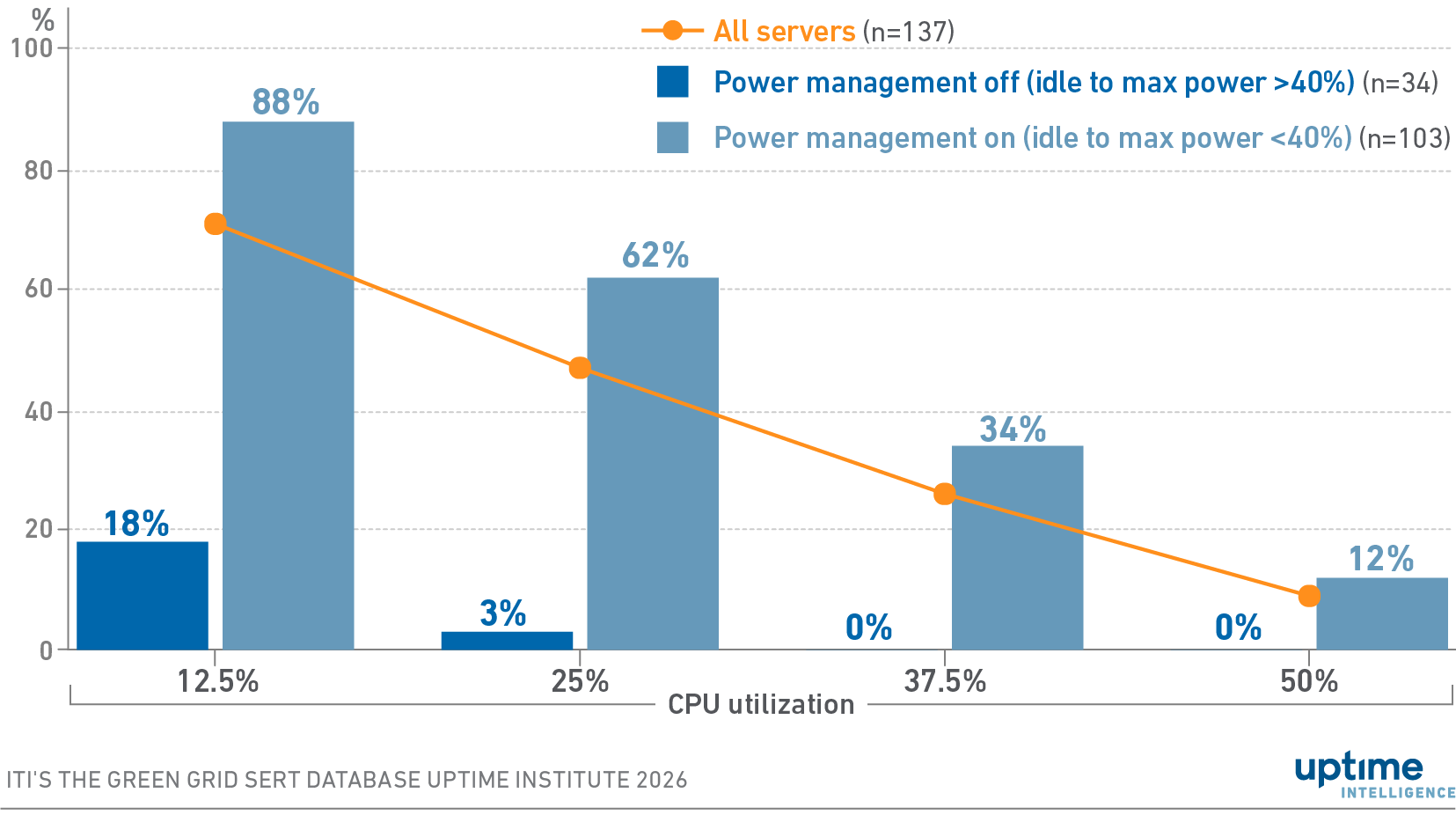

The proposed IT power utilization threshold has the unintended consequence of disincentivizing the deployment of server power management functions. ITI's The Green Grid Server Energy Efficiency Database (SEED) data for server configurations was used with 2023 AMD and Intel CPUs (Generation 4) to assess the effect of power management enablement on the proposed power utilization ratio. The Server Efficiency Rating Tool (SERT) power measurement data can be used to calculate the idle-to-maximum power ratio for a server configuration: if the ratio is <40%, it is assumed that power management functions are enabled.

The analysis shows that servers with power management enabled are significantly more likely to fall below the >55% utilization threshold than servers without power management (see Figure 1). It demonstrates that the methodology unintentionally incentivizes operators to disable efficiency features to meet the criteria.

Figure 1 Percentage of analyzed server configurations failing to reach 55% power utilization threshold

The approach also creates challenges for colocation data center operators, as they have limited visibility into tenants' equipment and usage. IT operators have been reluctant to provide the capacity and network information required under the EED. Without their tenant data, colocation operators will not be able to calculate their power utilization value to apply for the additional incentive.

French operators have been reporting energy consumption and related information through the OPERAT platform since 2022 under the Décret Tertiaire (decree number: 2019-771), which specifies identical operational PUE targets (1.2) for data centers >10,000 m² and a more relaxed target of 1.4 for facilities 1,000-10,000 m². Failure to comply with the Décret Tertiaire results in financial penalties and public naming. It should be noted that the Décret Tertiaire can allow for adjusted PUE targets to be applied, taking into account technical, architectural or economic constraints.

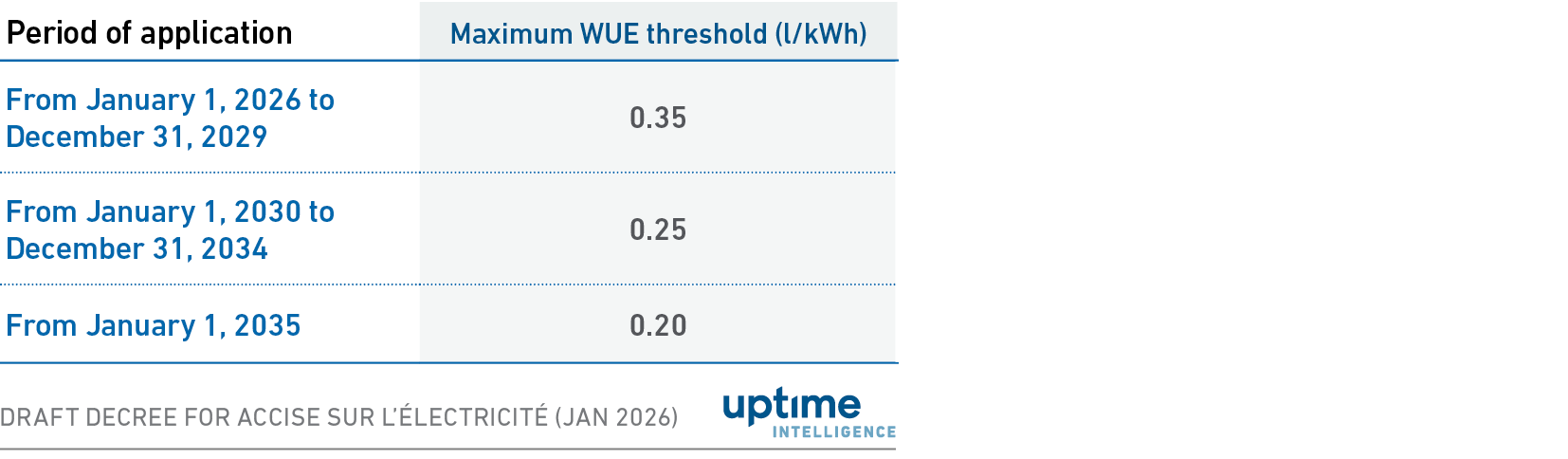

The Accise sur l'électricité further defines a set of WUE thresholds (see Table 3). According to a French official, the threshold values have been set to disincentivize excessive water use for data center cooling (i.e., inefficient water use).

Table 3 Thresholds for operational WUE

Published analysis of the 2024 WUE values calculated from the EU's EED data center database indicates that 80% of reporting data centers have a WUE <0.4 (regardless of water origin, whether it is potable or non-potable). This suggests that most data centers will meet the initial threshold of 0.35 l/kWh. French authorities have indicated that non-potable (recycled water or rainwater) may be excluded from the Accise sur l'électricité WUE calculation, potentially making additional data centers eligible for the tax incentive.

The Accise sur l'électricité WUE and PUE thresholds are still under evaluation by French authorities (stakeholder input was due by February 2, 2026) to avoid a potential negative impact, including on investment decisions. According to a French official, the final PUE thresholds for large (>10,000 m²) facilities may align with those set in the Décret Tertiaire, whereas smaller data centers could face slightly more stringent thresholds than those defined in the Décret Tertiaire.

The Uptime Intelligence View

Uptime Intelligence welcomes the French authorities' intent to favor data centers with high utilization of installed IT power, because this helps to ensure they use the reserved grid power they have been allocated (see Are data centers reserving too much grid power?). However, the drive to better utilize allocated power should not come at the expense of the efficient operation of the IT infrastructure. The proposed calculation method needs to be revised urgently to avoid encouraging operators to disable efficiency features to meet the power utilization criteria. In addition, "maximum server power" needs to be clearly defined, or another method for measuring server utilization should be introduced.

Tax reliefs may be an effective lever to motivate operators to report and drive efficiencies to qualify for the incentives on offer because electricity costs are a major operational cost for all data center operators. There is also a potential benefit in applying existing tax audit procedures to verify operator reporting.

Note: The regulatory analysis provided in this Update is the opinion of Uptime Intelligence. Data center operators should validate the interpretations with their legal staff and any relevant regulatory authorities.